THE ONLINE HOME FOR CO 4713 DIGITAL COMMUNICATION II

editor in chief / instructor of record : wendy roussin, mfa

Team 4: Story 2: The Costs Attached to Higher Education at MSU and Beyond

Money. It’s on the news; it’s on social media; it’s in everyday, casual conversation. The one place it’s not is in college students’ bank accounts.

The rising cost of higher and secondary education across the United States is not a recent phenomenon. The trend has been following this course for decades now. However, with the price currently at an all-time high, there is one question on everybody’s minds: how are students expected to face it?

According to the Office of Admissions and Scholarships, Mississippi State University awards several scholarships to students automatically on a case-by-case basis as well as being based on specific academic criteria. On the enrollment services1 website, there is a scholarship calculator available for students to determine how potential amounts through certain scholarships might aid them. Additionally, there are numerous additional scholarships opportunities but those require a submission from the student through the General Scholarship Application as well as applications to specific scholarships, such as departmental or private scholarships.

Also on the Office of Admissions and Scholarships website2 is a step-by-step process for applying for scholarships at MSU with deadlines and links listed.

There are a variety of ways that scholarships are distributed at Mississippi State University - determined solely by what type of scholarship it is. For academic-based scholarships, the admitted student’s ninth grade through eleventh grade transcripts, weighted GPA and ACT/SAT scores are considered and then the student is given a particular level of scholarship based on these factors.

“Those are automatic awards,” Lori Ball, Executive Director of Financial Aid and Scholarships in the Office of Financial Aid and Scholarships, said. “The student doesn’t have to do anything else for those.”

After a student is officially admitted to MSU, they immediately have access to the university’s scholarship portal where they can fill out the General Scholarship Application. This application asks a variety of questions such as community service involvement, extracurricular activities, honors received, work experience and many other factors.

“That scholarship system actually matches the student up with scholarships based on that,” Ball said. “So there’s a lot of scholarships that the student is not going to see within that application.”

Beyond this level, there are “Recommended Opportunities” within the scholarship portal which may require a bit of further, more specific information that is not asked about on the general application.

“If you’re a grandchild of a former athlete - we can’t ask that question on the general but there’s a separate application for that,” Ball said.

Additionally, there is another type of scholarship available at MSU attained through conditional applications, which are bound to specific colleges and majors - from the College of Arts and Sciences to the College of Agriculture and Life Sciences.

Those applying and attending MSU through an online-only program pay in-state tuition3, regardless of if they live in the state of Mississippi or not. There are even scholarships reserved only for online students, such as the “Distance Makes a Difference Scholarship” - totaling $1,000.

Mississippi State University’s largest college - the College of Arts & Sciences - awards over 200 scholarships4 each academic year, totaling close to half a million dollars to its recipients. Of those 200 scholarships, approximately 60 are sourced from the Dean’s Office and amounting to $204,000.

MSU’s Judy and Bobby Shackouls Honors College also presents its Presidential Endowed Scholarships specifically to incoming freshmen and are heralded as “Mississippi State University’s most prestigious freshman awards.”5 This scholarship awards approximately $107,000 to its recipients for the duration of their four years at MSU and can be used towards tuition, a meal plan, housing, study abroad experiences and undergraduate research. However, to be considered for this scholarship comes with quite the academic requirements, including a minimum of a 30 on the ACT or a 1360 on the SAT as well as a minimum of a 3.75 GPA. There are also rounds of interviews included in the application process.

On the international side of things, the International Institute6 and Office of Study Abroad also offers specific scholarships for its students studying abroad from MSU and those traveling abroad from their home countries to MSU.

Here is where the line is drawn between scholarships provided by the public university that is MSU and scholarships funded by private individuals or foundations.

Each year, the executive management committee handling tuition, scholarships, funding and all other financial matters convenes to examine all things money within MSU - either money funneling in or money being pushed outwards. When looking at scholarships for any given academic year, the committee notes where students are coming from - either in-state or out-of-state - and who will be eligible for what automatic scholarships based on grades, test scores and other factors. Leadership and service scholarships go through a similar evaluation process as well.

However, private scholarships are handled a bit differently. Private scholarships are created and managed through the relationship between both the university itself and the foundation footing the bill on its own scholarship.

“There’s a gift agreement that they’ll go through that puts all the criteria for the scholarships and writing really what the donor wants. You know, because they’re giving us the money and they’re telling us how they want it spent, basically,” Ball said.

Endowments are a type of scholarship that continuously earn money each year and span multiple semesters while there are also one-time donation scholarships that can last for a single scholarship distribution and will not be recurring after the money is spent. On the chance that a scholarship is not awarded due to a lack of students applying for it or for any other possible reason, it is simply held until the next scholarship-awarding period.

The only competition or restriction to the distribution of scholarships at MSU falls under the scholarships awarded through the General Scholarship Application portal. The academic, automatic scholarships will never run out of funding - regardless if the incoming pool of students is 10 or 10,000.

At MSU, if a student has a parent or legal guardian that is a faculty member or a professor within the school that student receives half-off tuition. If the student has both parents in this position, they receive 100% free tuition. Despite this, these students are still eligible for scholarships in addition to their discounted or free tuition. The only limitation to these students’ scholarships is that they cannot go over the cost of attendance, which includes everything entailed with coming to MSU for a nine-month academic year - from room-and-board to textbooks to even the tuition itself.

On the federal, nationwide side of scholarships, there are not necessarily less scholarships available to students seeking higher education. Rather, the process of finding available scholarships is a bit different due to not being necessarily attached to a specific college or university.

Scholarship America7 is a nonprofit organization founded with the mission to “eliminate financial barriers to students’ dreams.” Since 1958, it has awarded approximately $5.7 billion to over 3.2 million students with $315 million distributed in 2024 alone and 20,000 of the recipients supported last year were first-generation college students. Some of Scholarship America’s sponsors include household company names such as Amazon, Chick-fil-A, Intuit, Wells Fargo and PepsiCo. Scholarship America crafts its own custom scholarships for students while also connecting prospective students with the resources to find scholarships they are eligible for or suit their financial needs.

On the Federal Student Aid8 website - a place many university-level students are familiar with through filing and re-filing their annual Free Application for Federal Student Aid (FAFSA) form - the first thing students are told is that “Scholarships are gifts. They don’t need to be repaid.”

According to a 2021 report from U.S. News9, Trinity University, Samford University and The University of the South offer the most scholarships to their student bodies with 53%, 50% and 49% full-time students receiving merit aid during the 2019-2020 academic year at each, respectively.

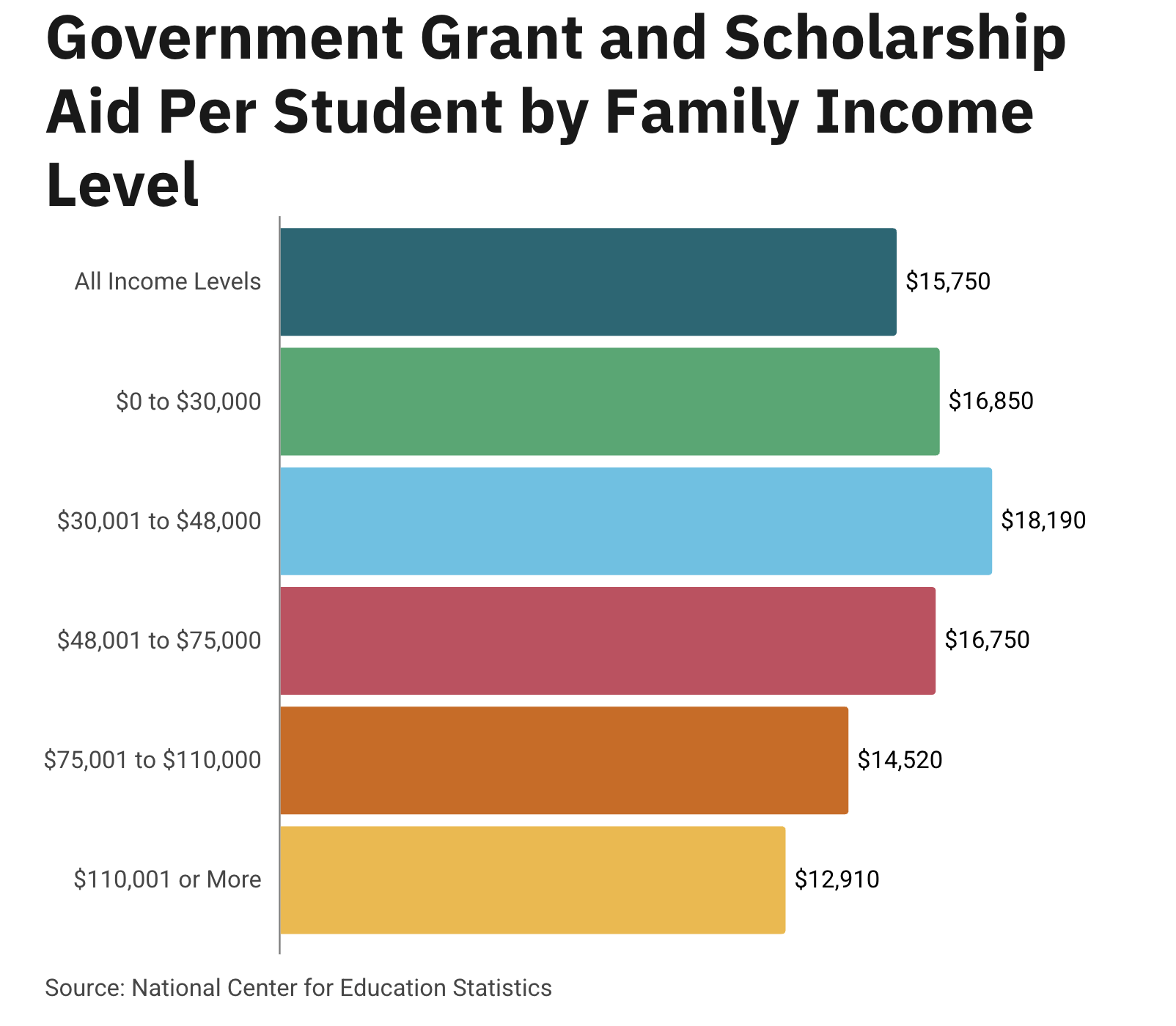

A report from the Brookings Institution and later published on Higher Education Today10 - under the umbrella of the American Council on Education11 - found that posted tuition prices have increased 114% since 1993 with the average net tuition after grants and scholarships being awarded only rose 46% in turn. By including tax credits, it was found that net tuition has largely flatlined since the 1990s while the annual borrowing and loan-withdrawing from students has tripled over that same period. However, this statistic and price tag can vary depending on what level of higher education or degree a student is working towards. Prices seemingly dropped for lower-income undergraduates while rising for both master’s students and higher-income undergraduates. It is projected that, soon, graduate-level students will possess half of all education-related debt.

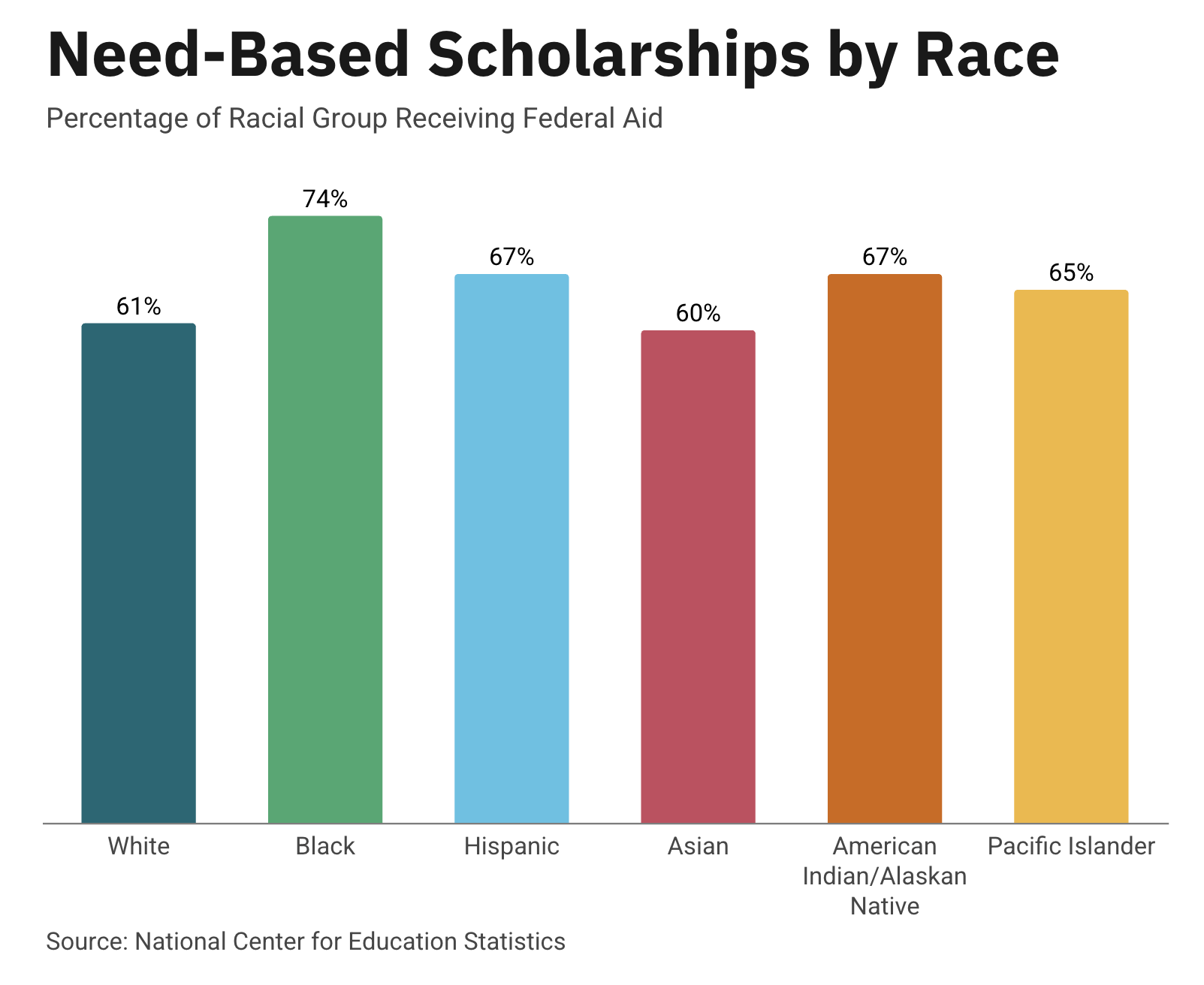

Finally, a series of reports from the Education Data Initiative12 last year compiled together all of the factors that can go into a student receiving a scholarship or not - such as public versus private four-year colleges, need-based scholarships determined by race and ethnicity and even scholarships awarded to student athletes with the differences between male and female sports.

For example, on average, male basketball players are given $38,246 in scholarships while females receive $36,758. Conversely, male collegiate gymnasts receive approximately $18,191 in scholarships while female gymnasts are given $40,172. However, athletic scholarships are typically awarded to less than 2% of high school athletes who go on to attend and compete on the collegiate level, leading to fewer than 180,000 students receiving athletic-based scholarships on an annual basis. Though, $2.7 billion is awarded to Division I and Division II athletes annually.

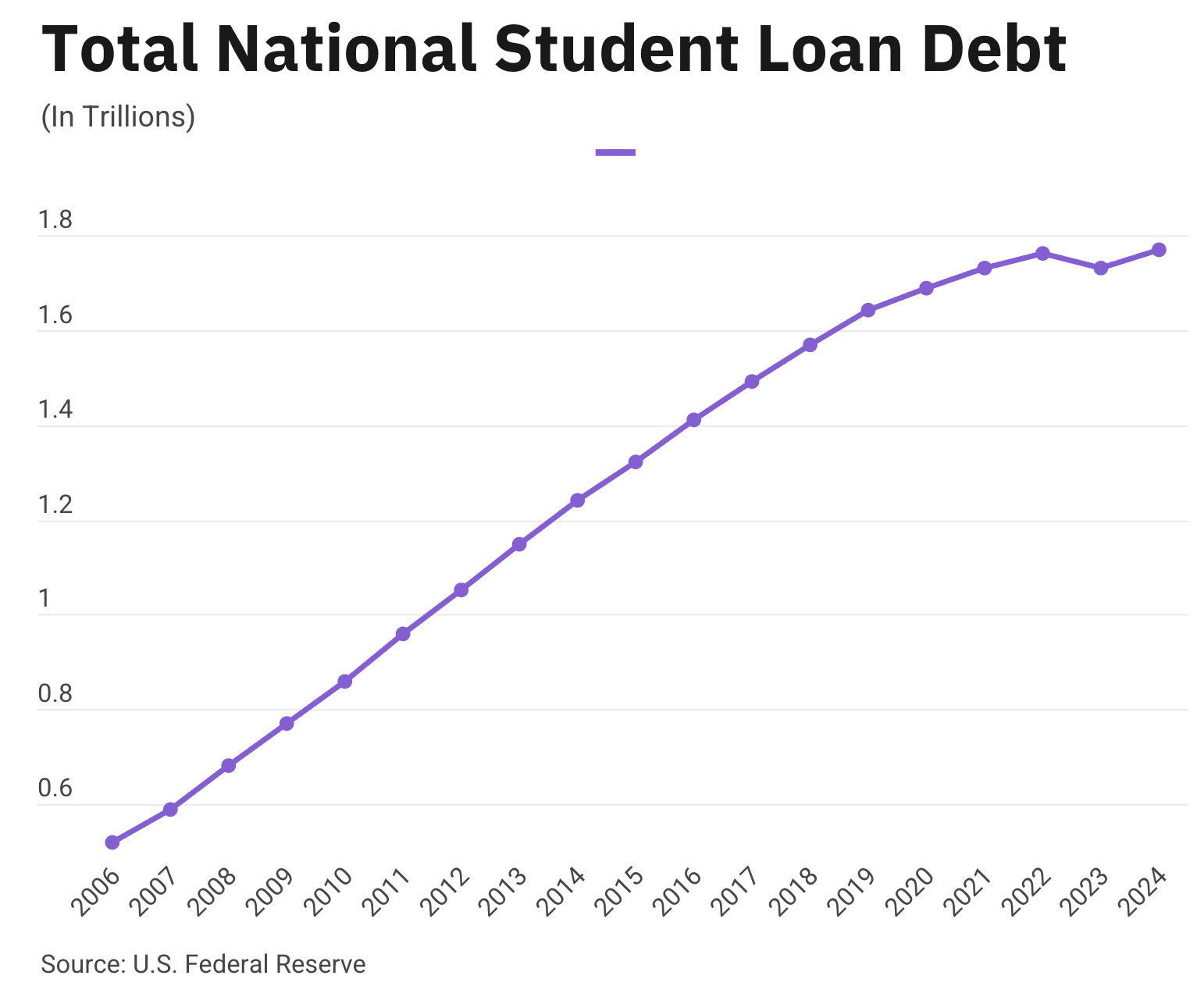

As a result of the ever-changing landscape of scholarships awarded to higher education students, there has been a profound impact on the personal debt the average person in the United States withdraws to split the difference with the rest of the price tag. This is especially prevalent among those seeking to work in more in-demand, competitive fields, which has steadily increased since the turn of the 21st century.

In addition to the overall uptick in borrowing, the push and pressures of society toward degrees beyond a bachelor’s, such as master’s and doctorates, has drastically increased nationwide student debt - particularly due to the relaxing or outright removal of previously in-place borrowing limits for these levels of secondary education programs. For instance, net borrowing to attain a master’s degree has increased 435%. In that same time frame, taking out loans for a bachelor’s degree has approximately tripled.

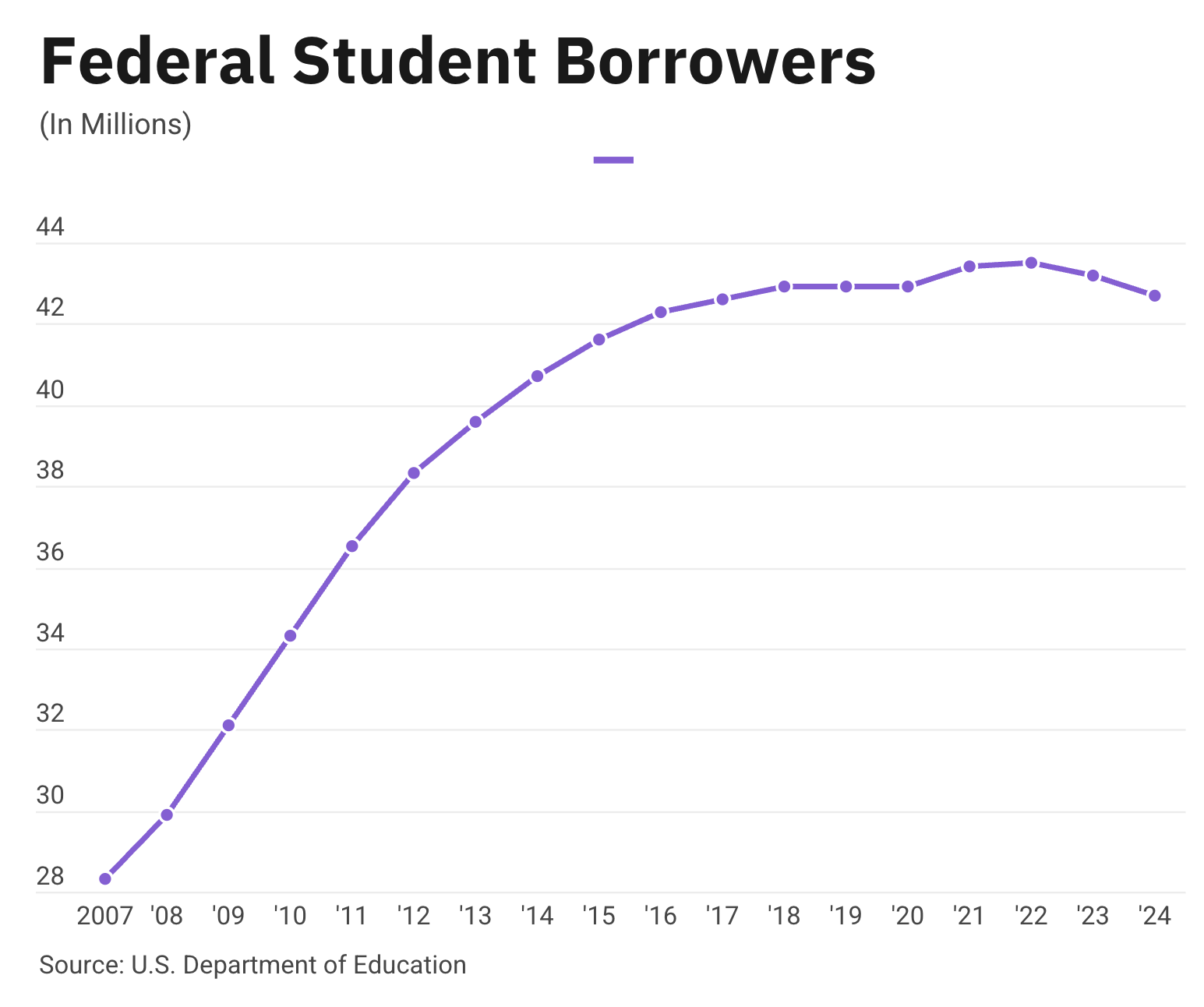

The impacts of this trend in the form of a percentage does not appear as detailed until it is taken a step further and examined as to why it is occurring. The same study discovered that, to achieve an undergraduate degree, what used to be 4.5 million students in the year 2000 shouldering loans had increased to 9.3 million in 2012. Over a decade later, it has only seen further exponential growth.

However, the loan-requiring barrier of entry for students has not decreased or deterred those seeking higher education. With a workforce exceedingly becoming more educated and outfitted with higher-level degrees, the value of the lower end of degrees is diminishing. This creates a vacuum of debt and a return-on-investment transforming into nothing more than a race for the finish line. In turn, many advertised “entry” level positions across a variety of career fields are demanding loftier standards of education and experience from students still in-school or recently graduated.

Inevitably, a cycle has manifested.

A demand for higher degrees curates a higher bill for those degrees. Therefore, students seeking the careers they desire will need those degrees to pursue it.

Hence, they need to also find a way to pay for it - most commonly with loans. Lots and lots of loans.

As of 2024, the official amount of student debt in the United States is $1.777 trillion with an average of approximately $88,000 per student. For comparison, this average rate of debt is higher than 50% of the average American citizen’s annual income. Accruing debt, refinancing and even further education only exacerbates the problem.

How does the student body at Mississippi State University feel?

A common complaint heard amongst the upcoming graduates at MSU is how difficult it is to find a job that will, hopefully, turn into a lifelong career following the walk across that stage. After the standard four years and large sums of money for that degree at the end of the tunnel, shouldn’t students be set up for success?

Unfortunately, it has become common practice for employers to label themselves as “entry-level” while requiring three-to-five years of previous experience in addition to that hard-earned bachelor’s degree.

Once more, a cyclical feeling begins to fester: the student needs the job for the experience, but the job requires experience. The cherry on top?

Most students need a job right out of graduation to begin paying off those loans they signed for to afford the past four years of secondary education.

The question arises: was college even worth it then?

According to the Education Data Initiative, 19.28 million students13 are enrolled in schools at the university-level in 2025, which appears to be a large sum. However, this is actually a significant decrease of 8.34% since 2010. In the Magnolia State specifically, this reduction is far more significant - a 25% decline of enrolling students since 2020.13

A commonly cited reason for this decline in enrollment can trace its roots to the spreading, nationwide opinion that college may not be worth the cost. In an attempt to gather a consensus on the public’s opinion of secondary education, Pew Research conducted a survey where it was discovered only one out of four14 Americans claim that it is very important to have a bachelor’s degree to secure a career and 22% of people14 stand by the ideal that the cost of a college degree is always worth it, even if it requires loans and the resulting debt.

Now, statistics reveal that 52%15 of recent college graduates find themselves unemployed. Even more frightening, 45% of that same group remain unemployed for a full decade post-graduation.

Careers are vital to economic success for university graduates - no matter the degree level. Conversely, the economical and societal landscape to secure a career has never been more difficult.

There are ways to circumvent and combat these struggles. Options, when explored and enacted throughout the collegiate experience, have been found to drastically increase the likelihood of landing a job fresh out of the classroom.

Doing consultant work, working on career-related personal projects and completing major-adjacent internships are just a few ways to beef-up one’s background before entering the “real world”. The primary pitfall of the latter is that similar to full-time jobs themselves, many entry-level internships require experience, are unpaid or are volunteer based.

The rising cost of higher education is having a cyclical effect on the economics of education itself: as the prices go up, so does the investment. Due to workforce demand, more students are achieving the necessary degrees - gradually increasing supply until the baseline will be forced to rise and the rest of society will begin to require the next level of degrees while increasing the cost as needed. While the price of college tuition increases in response to availability, students shoulder more loans to face those rising costs. Higher demand and lower “quality” supply will always artificially escalate the price of anything - from groceries to an aspiring student’s future.

Email the team at edn80@msstate.edu with any questions.

View our Sources.